Suppose you lend $1,000 at an interest rate of 10 percent over the next year

If the expected real interest rate at the beginning of the loan contract is 4 percent, then what rate of inflation over the upcoming year would be most beneficial to you as the lender? An inflation rate

A) equal to 4 percent. B) equal to 0 percent.

C) equal to 6 percent. D) greater than 6 percent.

B

You might also like to view...

In a competitive market, a decrease in consumer demand leads to

a. a decrease in output b. an increase in output c. economic profits d. higher prices e. technological innovation

Explain the money multiplier and give two examples showing how much money could be generated from a single deposit. For each example, be sure to include the initial deposit amount, the reserve requirement ratio, the excess reserve amount, the money multiplier, and the potential total amount of money generated, rounding to the nearest tenth at each step.

What will be an ideal response?

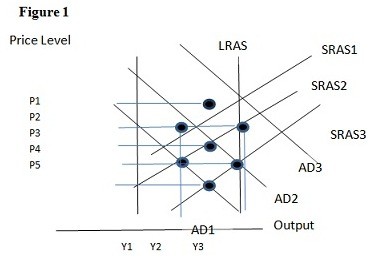

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the short run would be:

A. P3 and Y1. B. P2 and Y1. C. P2 and Y3. D. P1 and Y2.

A supply schedule illustrates the quantity supplied at

A. market equilibrium. B. different selling prices. C. various demand levels. D. a single selling price.