A commercial bank has checkable-deposit liabilities of $500,000, reserves of $150,000, and a required reserve ratio of 20%. The amount by which a single commercial bank and the amount by which the banking system can increase loans are respectively

A. $100,000 and $500,000.

B. $50,000 and $250,000.

C. $50,000 and $500,000.

D. $30,000 and $150,000.

Answer: B

You might also like to view...

Suppose a Chinese restaurant provides free tea and fortune cookies to its customers. The restaurant is clearly

A) generating a negative externality. B) generating a positive externality. C) selling food below cost. D) attempting to increase its total profit. E) doing none of the above.

Hired housekeepers, nannies, and cooks, working in households as either employees or self-employed persons, earn incomes for productive services that are not counted in GDP

Indicate whether the statement is true or false

When supply increases and at the same time demand decreases, we

A) can predict that both equilibrium price and quantity will increase. B) can predict that both equilibrium price and quantity will decrease. C) cannot predict equilibrium quantity, but know that equilibrium price will decrease. D) cannot predict the change in either the equilibrium quantity or equilibrium price.

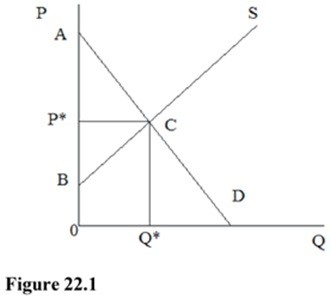

In Figure 22.2 and ignoring any possible externalities, the net benefit to society of this market is

A. 0P*CQ* B. ABC C. 0BCQ* D. BP*C