Your bank has the following balance sheet:

Assets Liabilities

Reserves $ 50 million Checkable deposits $200 million

Securities 50 million

Loans 150 million Bank capital 50 million

If the required reserve ratio is 10%, what actions should the bank manager take if there is an unexpected deposit outflow of $50 million?

After the deposit outflow, the bank will have a reserve shortfall of $15 million. The bank manager could try to borrow in the Federal Funds market, take out a discount loan from the Federal Reserve, sell $15 million of the securities the bank owns, sell off $15 million of the loans the bank owns, or lastly call-in $15 million of loans. All of the actions will be costly to the bank. The bank manager should try to acquire the funds with the least costly method.

You might also like to view...

In a business cycle boom, we expect an unusually ________ proportion of actual income to be transitory, thus an unusually ________ MPC operating in the short run, which ________ the income multiplier for the short run

A) high, low, reduces B) high, low, increases C) high, high, reduces D) low, low, increases E) low, high, reduces

GDP per capita is a relatively good measurement of:

A. the distribution of income. B. purchasing power. C. household production. D. the standard of living.

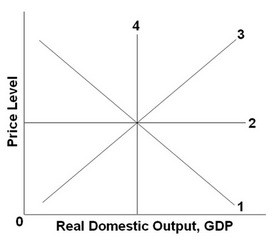

Refer to the above graph. As the price level changes, real domestic output remains constant with which line?

Refer to the above graph. As the price level changes, real domestic output remains constant with which line?

A. 1 B. 2 C. 3 D. 4

In international trade the term "dumping" means

A) price discrimination by domestic producers. B) selling goods in a foreign market for a price less than on the home market. C) selling goods in a home market for a price less than on the foreign market. D) selling goods on the black market to avoid paying taxes.