If you invested in an equally-weighted portfolio of stocks A and B, your portfolio return would be ___________ if economic growth were moderate.

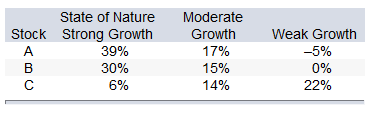

There are three stocks: A, B, and C. You can either invest in these stocks or short sell them. There are three possible states of nature for economic growth in the upcoming year (each equally likely to occur); economic growth may be strong, moderate, or weak. The returns for the upcoming year on stocks A, B, and C for each of these states of nature are given below:

A. 3.0%

B. 14.5%

C. 15.5%

D. 16.0%

C. 15.5%

E(Rp) = 0.5(17%) + 0.5(15%) = 16%.

You might also like to view...

Cash flow per share is usually higher than earnings per share

Indicate whether the statement is true or false

Which of the following is true about secondary data?

A) It is always current and, unlike primary data, it does not have to be updated. B) Unlike primary data, it can be obtained by using direct surveys and questionnaires by the company. C) It cannot provide extra information a company is looking for. D) It can be obtained more quickly and at a lower cost than primary data. E) It requires more effort compared to gathering primary data.

In reference to protection of private and intellectual property rights, IPRI stands for ______.

A. Intellectual Property Rights Index B. Internal Property Rights Index C. International Proprietary Reference Index D. International Property Rights Index

Balzotti placed a sofa too close to a baseboard heater. The fabric on the sofa was severely scorched in several places. Can Balzotti recover under a standard fire insurance policy?