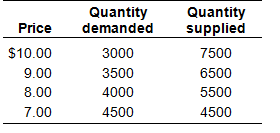

Use data in the following table to explain the economic effects of a price floor at $8, at $9, and at $10. Explain the economic effects

A price floor means that the price is not allowed to fall below a minimum price set by government. If the price floor is above the competitive equilibrium price of $7, a surplus of the product would result. If the price floor was set at $8, the quantity demanded would be 4000 units but the quantity supplied would be 5500 units for a surplus of 1500 units. At a price floor of $9, the surplus would be 3000 units, and with a price floor of $10, the surplus would be 4500 units. A price floor interferes with the rationing function of price that serves to balance the decisions of suppliers and salamanders. The price floor that produces a surplus indicates that resources are being over allocated and that there is economic inefficiency; output is being produced which consumers do not want to purchase at the price floor.

You might also like to view...

Assume that there are only two good for a consumer to purchase. Explain why a consumer can not be maximizing utility if both goods are inferior.

What will be an ideal response?

Most LDCs face the problems of low population growth and excessive saving

a. True b. False Indicate whether the statement is true or false

A low rate of inflation, whereby prices increase so slowly from week to week that we hardly notice the change, is referred to as

a. zero inflation b. creeping inflation c. nominal inflation d. real inflation e. episodic inflation

The Fed is often considered the bankers' bank because it

a. demands much more currency than it has available b. no longer has a monopoly on printing paper currency c. lowers the discount rate in order to restrict the money supply d. holds banks' reserves, provides banks with currency and loans, and clears their checks e. refuses to use its power of open market operations when a quorum of state-chartered bankers petitions it