Adjustors working for a large insurance agency are each given a company car which they use on the job to travel to client locations to inspect damage to homes and automobiles that are covered by the agency. Although the cars are owned by the agency, maintenance is currently left up to the discretion of the adjustors, who are reimbursed for any costs they report. The agency believes that the lack of a maintenance policy has led to unnecessary maintenance expenses. In particular, they believe that many agents wait too long to have maintenance performed on their company cars, and that in such cases, maintenance expenses are inordinately high. The agency recently conducted a study to investigate the relationship between the reported cost of maintenance visits for their company cars (Y) and

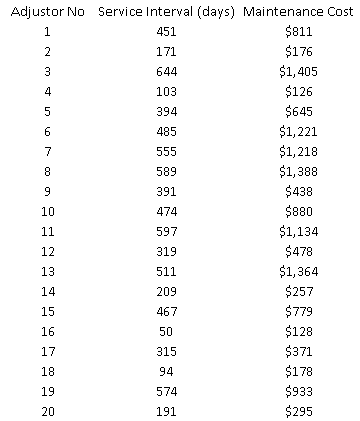

the length of time since the last maintenance service (X). The sample data are shown below:

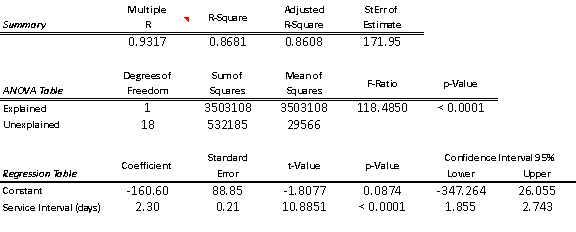

(A) Estimate a simple linear regression model with Service Interval (X) and Maintenance Cost (Y). Interpret the slope coefficient of the least squares line as well as the computed value of

?

(B) Do you think this model proves the agency's point about maintenance? Explain your answer.

?

(C) Obtain a residual plot vs. Service Interval. Does this affect your opinion of the validity of the model in (A)?

?

(D) Obtain a scatterplot of Maintenance Cost vs. Service Interval. Does this affect your opinion of the validity of the model in (A)?

?

(E) Use what you have learned about transformations to fit an alternative model to the one in (A).

?

(F) Interpret the model you developed in (E). Does it help you assess the agency's claim? What should the agency conclude about the relationship between service interval and maintenance costs?

What will be an ideal response?

?

(A) As the service interval increases by one day, the cost of maintenance increases by $2.30 on average. This simple linear regression model explains 86.8% of the total variation in the maintenance cost.

?

(B) The model above shows a strong relationship between the variables, as shown the by R2 of almost 87%. Maintenance costs do indeed increase with each day that passes, although that might be somewhat expected. What the agency is really trying to show, however, is that costs are higher than expected for longer intervals. In that case, they might hope to see a better fit from a non-linear model with an upward-curving function.

?

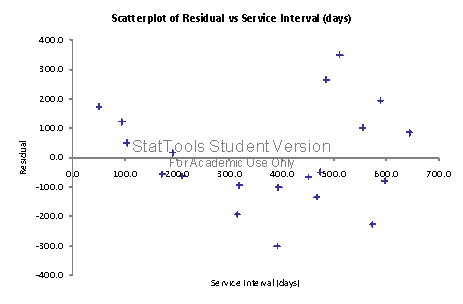

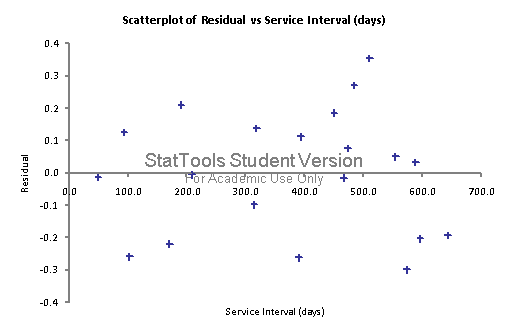

(C)

?

?

The residual plot shows positive residuals for large and small service intervals, and negative residuals for values in the middle of the range. This indicates that a linear fit may not be the best one for this data, even though the R2 is relatively high.

?

?

?

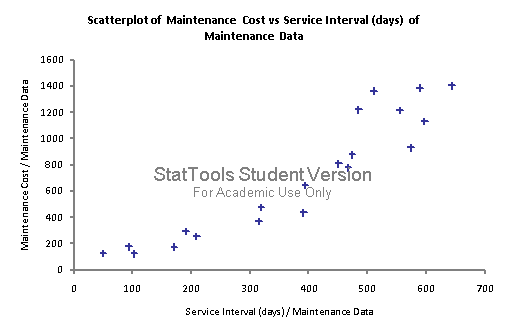

(D)

?

The scatterplot confirms what the residual plot indicated; a linear fit may not be the best one for this data. As the agency suspects, there is an upward-curving trend in the data points.

?

?

?

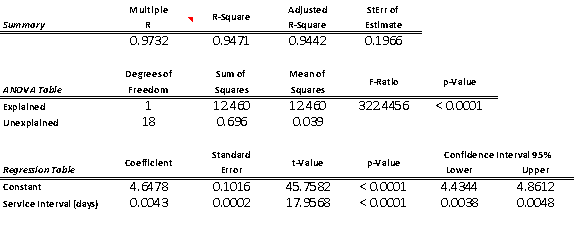

(E)

?

The above output is for a regression of log(maintenance cost) on service interval. This model improves the R2 to almost 95%, although we cannot compare it directly to the model in (A) because the dependent variable has changed. However, the residual plot shown below looks much more acceptable (patternless distribution of residuals) than the one shown in (C).

?

?

?(F) The model above shows that maintenance costs increase by a constant 0.4% for each addition day in the service interval. Over time this can add up to significant maintenance expenses, as shown in the scatterplot in (D). The agency might indeed reduce maintenance costs if it can convince or require its adjustors to have their cars services on a smaller, regular interval.

?

You might also like to view...

Journals are sometimes called books of original entry because transactions are recorded in journals before amounts are entered into the ledger.

Answer the following statement true (T) or false (F)

Identify the major features of effective sales force compensation plans.

What will be an ideal response?

A major benefit to firms that rely on accounts payable as a source of short-term financing is that it can defer payment of goods and services received. A potential cost is that the firm might be foregoing discounts for early repayment

Indicate whether the statement is true or false

Insurance companies invest the premiums and fees collected from customers in order to neutralize the risks assumed from their clients

Indicate whether the statement is true or false.