Describe what the liquidity trap is. Explain how it can be problematic for monetary policymakers

What will be an ideal response?

The liquidity trap describes the situation in which the demand for money is insensitive to changes in interest rates (i.e., the money demand curve is infinitely elastic). In this case, monetary policy has no direct affect on aggregate spending because a change in the money supply will not affect interest rates.

You might also like to view...

Seignorage is the revenue a government raises by

A) taxation. B) printing money. C) borrowing money. D) charging fees for services.

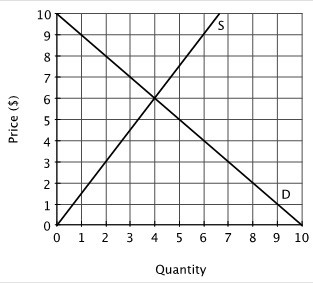

Refer to the accompanying figure. At a price of $3, there will be:

A. an excess demand of 7 units. B. an excess supply of 7 units. C. an excess demand of 5 units. D. an excess supply of 2 units.

The discount rate is the rate of interest charged when banks lend excess reserves to one another.

a. true b. false

A required element for specialization to lead to an increase in the satisfaction of society's wants is:

A. A capitalist economy B. Exchange and trade C. The use of money D. A central plan