Larry was accepted at three different graduate schools, and must choose one. Elite U costs $50,000 per year and did not offer Larry any financial aid. Larry values attending Elite U at $60,000 per year. State College costs $30,000 per year, and offered Larry an annual $10,000 scholarship. Larry values attending State College at $40,000 per year. NoName U costs $20,000 per year, and offered Larry a full $20,000 annual scholarship. Larry values attending NoName at $15,000 per year. Larry maximizes his economic surplus by attending:

A. NoName U because the annual cost is only $20,000.

B. NoName U because he has a full scholarship there.

C. State College.

D. Elite U.

Answer: C

You might also like to view...

Market equilibrium

i. can never occur because there are always people who want a good but cannot afford it. ii. occurs at the intersection of the supply and demand curves. iii. is the point where the price equals the quantity. A) ii and iii B) i only C) ii only D) i and ii E) iii only

The Obama administration increased the tax on the top income tax bracket from 35% to 39%

Supply and demand analysis predicts the impact of this change was a ________ interest rate on municipal bonds and a ________ interest rate on Treasury bonds, all else the same. A) higher; lower B) lower; lower C) higher; higher D) lower; higher

Which of the following would NOT allow society to move to point "h" in the above figure?

A) an improvement in technology B) more efficient use of current resources C) an increase in quantity of labor D) an increase in quantity of capital

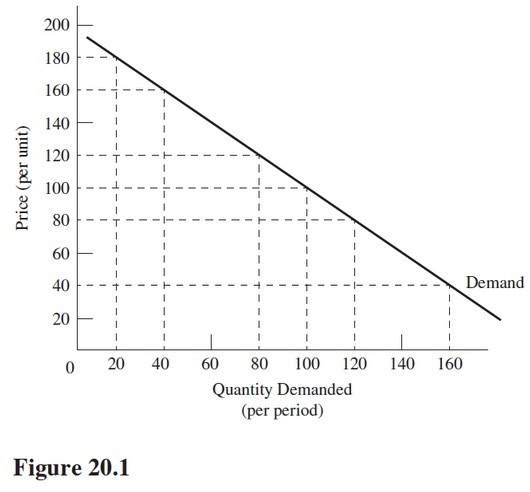

Over the price range from $180 to $120 in Figure 20.1, ceteris paribus,

A. Demand is increasing. B. Total revenue is maximized. C. Utility is maximized. D. Demand is elastic.