The amount appearing under equipment on the December 31, 2018 consolidated balance sheet would be:

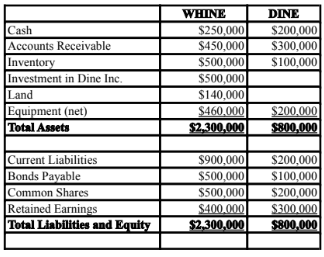

Whine purchased 80% of the outstanding voting shares of Dine Inc. on December 31, 2018. The balance sheets of both companies on that date are shown below (after Whine acquired the shares):

Also on December 31, 2018 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has

outstanding) to Chompster for $20 per share.

The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition.

Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2018.

A) $710,000. B) $690,000. C) $772,500. D) $785,000.

D) $785,000.

You might also like to view...

ASEAN is a(n)

A. trading bloc consisting of 10 countries in Asia. B. association of American and Southeast Asian nations. C. trading bloc consisting of 10 countries along the Atlantic Ocean. D. worldwide banking association. E. union of global nations that strives to bring world peace.

Book value equals original cost minus salvage value

Indicate whether the statement is true or false

Responsibility is ______.

a. the obligation to achieve objectives by performing required activities b. the right to make decisions, issue orders, and use resources c. how well individuals meet their objectives d. the clear line of authority from the top to the bottom of an organization, forming a hierarchy

A company may use several different cost drivers to allocate its indirect costs.

Answer the following statement true (T) or false (F)