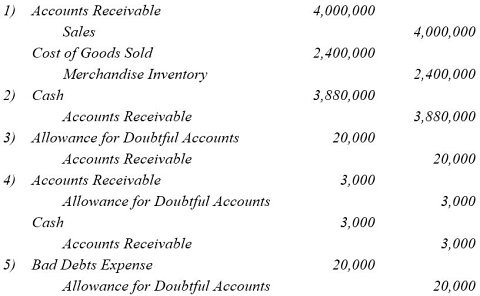

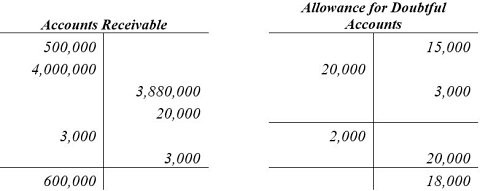

The Tulip Company uses the percent of receivables method of accounting for uncollectible accounts receivable, and a perpetual inventory system. As of January 1, its net accounts receivable totaled $485,000 (Accounts Receivable $500,000 less a $15,000 Allowance for Doubtful Accounts). During the current year, the following transactions occurred. 1)Merchandise costing $2,400,000 was sold on account for $4,000,000. 2)The company collected $3,880,000 from customers on account.3)$20,000 of accounts receivable were deemed uncollectible and written off.4)$3,000 of accounts receivable previously written off as uncollectible were recovered.5)At year-end, Lily Company estimates that 3% of its accounts receivable are uncollectible.Prepare journal entries to record these transactions.

What will be an ideal response?

You might also like to view...

According to a Forbes study, what percentage of executives agreed that diversity encourages innovation?

a. 10 percent. b. 50 percent. c. 68 percent. d. 85 percent.

Which of the following is true of U.S. immigration law?

A) An H1-B visa is granted only to foreign nationals skilled in specialty occupations. B) Individual applicants, and not employers, apply for H1-B visas. C) H1-B visa holders cannot bring their family as dependents to the U.S. D) H4 visa holders are allowed to work for minimum wages or more in the U.S.

Phoenix Corporation purchases 1,000 shares of its own stock from Stewart, a shareholder, at a price of $50 a share. These shares will be known as:

A) treasury shares. B) preemptive shares. C) preferred stock. D) no par stock.

Kiri acquires equipment (7-year property) on August 14, 2018, for $80,000. She does not elect to expense the asset under Section 179 or the 100% bonus. She sells the asset on January 15, 2022. a. What is Kiri's cost recovery deduction related to the equipment in 2018 and 2022? b. What is Kiri's cost recovery deduction related to the equipment in 2018 and 2022 if the 100% bonus is elected?

What will be an ideal response?