When interest rate rise consumers will

A) compare loan payments with the desirability of goods in the future and increase consumption.

B) compare loan payments with the desirability of goods today and increase consumption.

C) wait to borrow funds when interest rates fall.

D) none of above.

C

You might also like to view...

The NAAQS

a. are set using benefit-cost analysis b. are established using a benefit-based decision rule c. achieve efficient levels of abatement for the criteria pollutants d. both (a) and (c) are correct

If the Fed is concerned about a possible recession, it ________ the federal funds rate, which ________ the quantity of reserves and ________ the amount of bank loans

A) raises; increases; increases B) lowers; increases; increases C) raises; decreases; decreases D) lowers; increases; decreases E) lowers; decreases; decreases

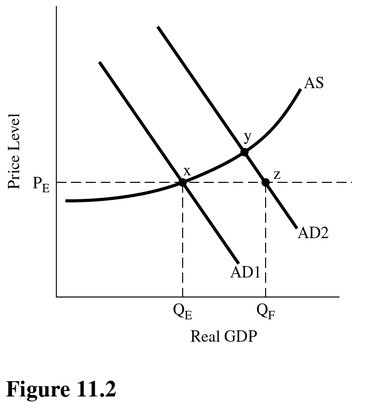

Assuming QF is the full employment equilibrium then in Figure 11.2, if the level of spending is equal to AD1, the AD shortfall would be

Assuming QF is the full employment equilibrium then in Figure 11.2, if the level of spending is equal to AD1, the AD shortfall would be

A. Equal to YZ. B. Greater than XZ. C. Equal to XY. D. Equal to XZ.

The self-correcting tendency of the economy means that falling inflation eventually eliminates:

A. exogenous spending. B. recessionary gaps. C. expansionary gaps. D. unemployment.