Lowman Inc sells a product with a sales price of $25 per unit, variable costs of $10 per unit, and total fixed costs of $100,000. Lowman is looking into implementing an aggressive advertising campaign that will cost $45,000. By what amount do sales dollars need to at least increase by in order for the company's overall profits to not decrease by having the advertising campaign?

The contribution margin needs to increase by at least $45,000 in order for the company to just break even on the advertising campaign. In order to increase the contribution margin by $45,000, sales dollars need to increase by at least $75,000 calculated as follows:

Contribution margin ratio x Sales dollars increase = Increase in contribution margin

Contribution margin ratio = $15 ¸ $25 = 60%

Therefore: 60% x Sales dollars increase = $45,000

Sales dollars increase = $75,000

You might also like to view...

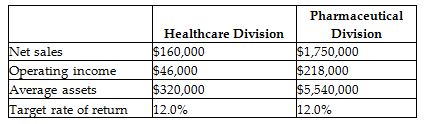

Guardian Corporation has two major divisions— Healthcare Products and Pharmaceutical Products. It provides the following information for the year.

Calculate the residual income for the Healthcare Division.

A) $26,800

B) $7600

C) $114,000

D) $46,000

The typical audience for an executive summary is usually:

a. executives b. technical experts c. all readers d. none of the above

The right physical distribution system should be based primarily on

A. the physical characteristics of the product. B. the desired customer service level. C. how customers store the product. D. what is the lowest cost method of transportation for the product. E. the inventory level that allows the smoothest production runs.

Derby Inc. manufactures a product which contains a small motor. The company has always purchased this motor from a supplier for $125 each. Derby recently upgraded its own manufacturing capabilities and now has enough excess capacity (including trained workers) to begin manufacturing the motor instead of buying it. The company prepared the following per unit cost projections of making the motor, assuming that overhead is allocated to the part at the normal predetermined overhead rate of 150% of direct labor cost. Direct material$38 Direct labor 50 Overhead (fixed and variable) 75 Total$163 The required volume of output to produce the motors will not require any incremental fixed overhead. Incremental variable overhead cost is $21 per motor. What is the effect on

income if Derby decides to make the motors? A. Income will increase by $16 per unit. B. Income will decrease by $16 per unit. C. Income will increase by $23 per unit. D. Income will increase by $39 per unit. E. Income will decrease by $23 per unit.