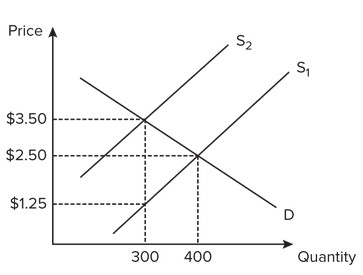

Use the following graph for a competitive market to answer the question below. Assume the government imposes a $2.25 tax on suppliers, which results in a shift of the supply curve from S1 to S2. The amount of the tax paid by the seller is

Assume the government imposes a $2.25 tax on suppliers, which results in a shift of the supply curve from S1 to S2. The amount of the tax paid by the seller is

A. $2.25.

B. $0.

C. $1.00.

D. $1.25.

Answer: D

You might also like to view...

A large farming operation which uses a potent fertilizer is located up river from a trout farmer. If property rights of the river exist and transactions costs are low, the amount of pollution will be ________

A) efficient only if the trout farmer owns the river B) inefficient if the farming operation owns the river C) efficient if either the farming operation or the trout farmer own the river D) always inefficient

A demand curve with unit elasticity can never touch either the vertical or horizontal axes.

Answer the following statement true (T) or false (F)

A perfectly competitive industry is in long-run equilibrium. Some firms in the industry adopt new technology that reduces the average total cost of producing the good

In the long run, the price is ________, firms with the new technology make ________ economic profit, and firms with the old technology ________. A) lower; zero; exit the industry B) constant; a positive; make zero economic profit C) lower; zero; switch to the new technology or exit the industry D) constant; zero; exit the industry

When the Fed lowers the federal funds rate ________

A. aggregate demand increases the same day B. investment increases, but only after the economy's growth rate rises C. the quantity of money and loans increase in the short term D. the inflation rate increases about two years later