Lump-sum taxes are rarely used in the real world because

a. while lump-sum taxes have low administrative burdens, they have high deadweight losses.

b. while lump-sum taxes have low deadweight losses, they have high administrative burdens.

c. lump-sum taxes are often viewed as unfair because they take the same amount of money from both poor and rich.

d. lump-sum taxes are very inefficient.

c

You might also like to view...

Which one of the following is part of the official money supply in the United States?

a. Federal Reserve Notes. b. Gold bars. c. Common stock. d. Silver coins.

During most of the 1990s, average hours worked per week ____, then, after 2000 . started to ____

a. rose steadily; level off b. remained virtually constant; drop slowly. c. were on the upswing; fall slowly. d. continued to decline; level off

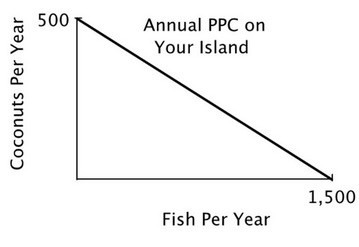

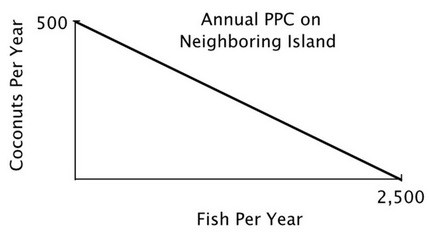

You are the Minister of Trade for a small island country with the following annual PPC: You are negotiating a trade agreement with a neighboring island with the following annual PPC:

You are negotiating a trade agreement with a neighboring island with the following annual PPC: What's the minimum number of fish you would be willing to accept in exchange for a coconut?

What's the minimum number of fish you would be willing to accept in exchange for a coconut?

A. 4 B. 3 C. 5 D. 2

McDonald's introduced the Big Mac in 1968, and it turned out to be a hit. However, the Arch Deluxe, introduced in 1996, was not. The success or failure of a product in the market system is determined by

What will be an ideal response?