Consider a worker who consumes a composite consumption good (on the vertical axis) and leisure hours (on the horizontal axis).

a. Suppose the worker has 80 hours of leisure per week and can earn a wage of $50 per hour. Illustrate the worker's weekly budget constraint.

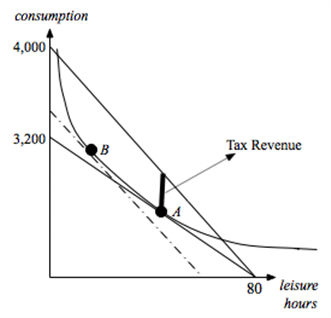

b. In order to close the deficit, the government introduces a broad-based consumption tax on all consumer goods -- raising the price of the consumption good by 20%. Illustrate the new budget constraint faced by our worker.

c. On your graph, indicate the level of tax revenue raised by this broad-based consumption tax.

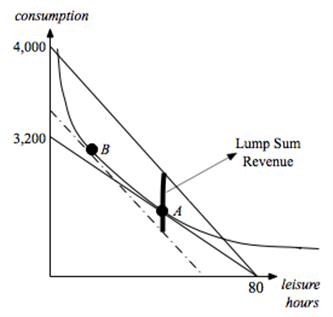

d. Using your graph, discuss why this tax is inefficient.

e. In this model is there any difference between the consumption tax and a wage tax? What is different about the real world that would change your conclusion about this?

What will be an ideal response?

b. This is the shallower of the two solid budget constraints in the graphs below.

c. This is illustrated in the first graph as the vertical distance above A.

d. The second graph shows how much could have been raised from this worker without making him worse off if we used a lump sum tax that does not distort prices. Since this is larger than what we actually raise in the first graph, the tax is inefficient.

e. Within the model, a wage tax of 20% would look exactly the same way -- whether the worker is taxed at the time of receiving the paycheck or when he goes to the store to purchase goods is irrelevant to the analysis. In the real world, however, the worker might put part of his paycheck aside as savings. As a result, it matters whether the tax is taken out as he gets his paycheck or whether it is taken when he purchases goods. The broad based consumption tax differs from the wage tax in the real world because of the different impact the two might have on savings behavior and intertemporal choices.

You might also like to view...

Assuming all else equal, if a firm decides to pay more dividends and lowers the amount of retained earnings it holds, it will cause:

A) an upward movement along the current credit supply curve of the firm. B) a downward movement along the current credit supply curve of the firm. C) the current credit supply curve of the firm to shift to the left. D) the current credit supply curve of the firm to shift to the right.

The main policy making body of the Federal Reserve System is the

A) Federal Monetary Conditions Board. B) Board of Presidents of the Federal Reserve Banks. C) Board of Governors of the Federal Reserve System. D) Federal Open Market Committee. E) Board of Advisors.

Currently a country has real GDP per person of 500 . Raising capital per worker by one would increase output per worker by 4 . Other things the same, which of the following long-run combinations are consistent with the effects of this country increasing its saving rate?

a. real GDP per person is 520 and raising capital per worker by one would increase output per worker by 3 b. real GDP per person is 520 and raising capital per worker by one would increase output per worker by 5 c. real GDP per person is 480 and raising capital per worker by one would increase output per worker by 3 d. real GDP per person is 480 and raising capital per worker by one would increase output per worker by 5

The price of a coupon bond is determined by:

A. taking the present value of the coupon payments and adding this to the face value. B. taking the present value of all of the bond's payments. C. estimating its future value. D. taking the present value of the bond's final payment and subtracting the coupon payments.