Cadavieco Corporation has provided the following data for its two most recent years of operation:?Selling price per unit$90????Manufacturing costs:?? Variable manufacturing cost per unit produced:?? Direct materials$13? Direct labor$6? Variable manufacturing overhead$4?Fixed manufacturing overhead per year$224,000?Selling and administrative expenses:?? Variable selling and administrative expense per unit sold$5? Fixed selling and administrative expense per year$74,000??Year 1Year 2?Units in beginning inventory01,000?Units produced during the year8,0007,000?Units sold during the year7,0005,000?Units in ending inventory1,0003,000Required:a. Assume the company uses absorption costing. Compute the unit product cost in each

year.b. Assume the company uses absorption costing. Prepare an income statement for each year.c. Assume the company uses variable costing. Compute the unit product cost in each year.d. Assume the company uses variable costing. Prepare an income statement for each year.

What will be an ideal response?

a. Absorption costing unit product costs:

| ? | ? | Year 1 | Year 2 |

| ? | Direct materials | $13 | $13 |

| ? | Direct labor | 6 | 6 |

| ? | Variable manufacturing overhead | 4 | 4 |

| ? | Fixed manufacturing overhead ($224,000 ÷ 8,000 units produced; $224,000 ÷ 7,000 units produced) | 28 | 32 |

| ? | Absorption costing unit product cost | $51 | $55 |

b. Absorption costing income statements:

| ? | ? | Year 1 | Year 2 |

| ? | Sales [(7,000 units sold × $90 per unit); (5,000 units sold × $90 per unit)] | $630,000 | $450,000 |

| ? | Cost of goods sold [(7,000 units sold × $51 per unit); ((1,000 units sold × $51 per unit) + (4,000 units sold × $55 per unit)) = $51,000 + $220,000)] | 357,000 | 271,000 |

| ? | Gross margin | 273,000 | 179,000 |

| ? | Selling and administrative expenses [((7,000 units sold × $5 per unit) + $74,000); ((5,000 units sold × $5 per unit) + $74,000)] | 109,000 | 99,000 |

| ? | Net operating income (loss) | $164,000 | $80,000 |

c. Variable costing unit product costs:

| ? | ? | Year 1 | Year 2 |

| ? | Direct materials | $13 | $13 |

| ? | Direct labor | 6 | 6 |

| ? | Variable manufacturing overhead | 4 | 4 |

| ? | Variable costing unit product cost | $23 | $23 |

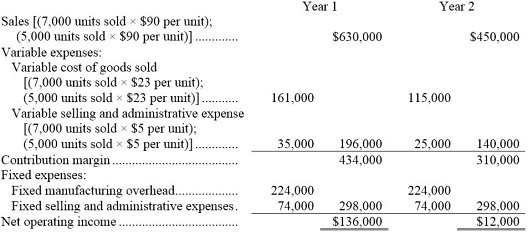

d. Variable costing income statements:

You might also like to view...

Marketers should assume that buyers will pass through the classic hierarchy of affective, cognitive, and behavioral stages, in that order

Indicate whether the statement is true or false

Which of the following is a performance measure?

A) Quality of raw materials used in production B) Number of orders shipped in a day C) Level of customer satisfaction D) All of these choices

An exculpatory clause must be reciprocal to be considered enforceable

Indicate whether the statement is true or false

Business intelligence (BI) systems have five standard components called hardware, software, data, procedures and people.

Answer the following statement true (T) or false (F)