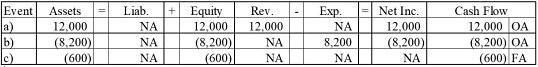

During Year 1, Sawyer Company earned $42,000 of cash revenue and paid $28,200 of cash expenses and $1,600 in dividends to the company's owners. Enter each of these three events into the horizontal financial statements model, below. Indicate dollar amounts of increases and decreases. For cash flows, show whether they are operating activities (OA), investing activities (IA), or financing activities (FA). Precede the amount with a minus sign if the transaction reduces that section of the equation or cash flow. Enter 0 if there would be no entry in a column.

What will be an ideal response?

You might also like to view...

Large aircraft manufacturers normally use:

A. Process costing. B. Job order costing. C. Full costing. D. Mixed costing. E. Simple costing.

The process whereby every transaction or event has at least two accounting entries is known as:

A) the accounting equation. B) ledger accounting. C) double-entry bookkeeping. D) the cash equation.

________ refers to the use of relevant text ads that appear as sponsored links along with the results of a particular word search in a search engine

A) Product placement B) Keyword advertising C) Flyposting D) Banner advertising

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 2018, prior to the business combination whereby Goodwin acquired Corr, are as follows (in thousands): Goodwin CorrRevenues$2,700 $600 Expenses 1,980 400 Net income$720 $200 Retained earnings, 1/1$2,400 $400 Net income 720 200 Dividends (270) (0)Retained earnings, 12/31$2,850 $600 Cash$240 $220 Receivables and inventory 1,200 340 Buildings (net) 2,700 600 Equipment (net) 2,100 1,200 Total assets$6,240 $2,360 Liabilities$1,500 $820 Common stock 1,080 400 Additional paid-in capital 810 540 Retained earnings 2,850 600 Total liabilities and stockholders' equity$6,240 $2,360 ??On December 31, 2018, Goodwin

obtained a loan for $600 and used the proceeds, along with the transfer of 30 shares of its $10 par value common stock, in exchange for all of Corr's common stock. At the time of the transaction, Goodwin's common stock had a fair value of $40 per share.??In connection with the business combination, Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs. At the time of the transaction, Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.?Compute the consolidated revenues for 2018. A. $920. B. $3,300. C. $720. D. $1,540. E. $2,700.