Suppose that a small business takes in monthly revenue of $200,000 . Labor, rental, energy, and other purchased input costs come to a total of $170,000 . The owner/entrepreneur's monthly opportunity cost of her time invested in the business is $5,000 (this is what she could earn working elsewhere), and the owner/entrepreneur could get a return of $5,000 each month if she sold her business and

invested the net proceeds in a financial asset such as a treasury bond. Which of the following correctly describes her monthly economic profit?

a. $200,000

b. $190,000

c. $30,000

d. $20,000

d

You might also like to view...

Are developing country cities too large, too small, or about right in size? Justify your answer with evidence from developing economies

What will be an ideal response?

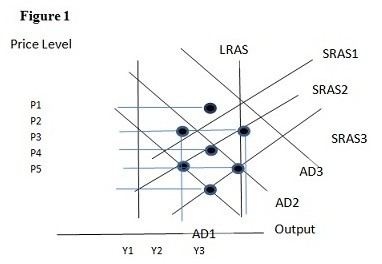

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y2. C. P3 and Y1. D. P2 and Y3.

Suppose that Japan and India are both engaged in the production of radios and rice, and that Japan has an absolute advantage in the production of both goods. If India has a lower opportunity cost for producing rice, then

A. India has a comparative advantage in the production of rice, but it is outweighed by Japan's absolute advantage in rice production. B. India has a comparative advantage in rice production, but there will be no gains from specialization and trade. C. Japan has a comparative advantage in the production of both goods. D. India has a comparative advantage in the production of rice, and specialization and trade between the two countries can be mutually beneficial.

If a product provides a positive externality, a duopoly

A) will provide more social welfare than a monopoly. B) will provide less social welfare than a monopoly. C) will provide the same social welfare as a monopoly. D) introduces an interesting and untested twist to the externality story.