Explain two reasons why the Fed does not have complete control over the level of bank deposits and loans. Explain how a change in either factor affects the deposit expansion process

What will be an ideal response?

The Fed does not completely control the level of bank deposits and loans because banks can hold excess reserves and the public can change its currency holdings. A change in either factor changes the deposit expansion process. An increase in either excess reserves or currency reduces the amount by which deposits and loans are increased.

You might also like to view...

The basic difference between macroeconomics and microeconomics is that

a. microeconomics is concerned with aggregate markets and the entire economy, while macroeconomics is concerned with specific individual markets. b. macroeconomics is concerned with policy decisions, while microeconomics applies only to theory. c. microeconomics is concerned with individual markets and the behavior of people and firms, while macroeconomics is concerned with aggregate markets and the entire economy. d. macroeconomics is concerned with positive economics, while microeconomics is concerned with normative economics.

A ________ demand curve for shampoo would be caused by a change in the price of shampoo.

A) positively sloped B) leftward shift of the C) rightward shift of the D) movement along the

A call option is:

A. an option where all rights are granted to the seller of the option. B. an option giving the seller the right to sell a given quantity of an asset at a specific price on or before a specified date. C. any option written more than sixty days into the future. D. an option giving the holder the right to buy a given quantity of an asset at a specific price on or before a specified date.

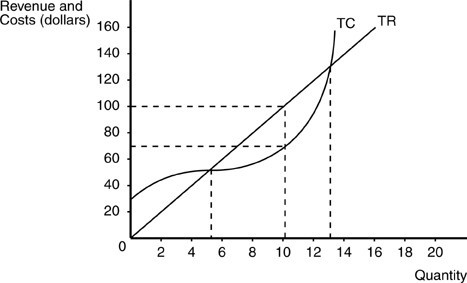

In the above figure, at the profit-maximizing rate of production for the perfectly competitive firm, profit is

In the above figure, at the profit-maximizing rate of production for the perfectly competitive firm, profit is

A. $70. B. $30. C. $130. D. $100.