In an effort to balance the federal budget, an increase in Social Security taxes is passed. What is the most likely effect of this on equilibrium GDP?

a. GDP will increase.

b. GDP will decrease.

c. GDP will not change but prices will rise.

d. GDP will not change but employment will increase.

b

You might also like to view...

In the above figure, the imposition of a $0.25 sales tax on sellers will

A) raise the market price paid by buyers of hotdogs by $0.25. B) lower the market price paid by buyers of hotdogs by $0.25. C) raise the market price paid by buyers of hotdogs by $0.125. D) have no effect on the market price of hot dogs.

The demand curve facing a perfectly competitive firm is

A) the same as the market demand curve. B) downward-sloping and less flat than the market demand curve. C) downward-sloping and more flat than the market demand curve. D) perfectly horizontal. E) perfectly vertical.

If there are no unintended changes in inventories, the economy is at its equilibrium level of real gross domestic product (GDP) demanded

a. True b. False Indicate whether the statement is true or false

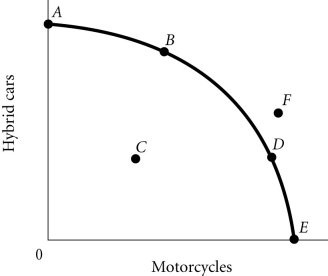

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, as the economy moves from Point D to Point B, the opportunity cost of hybrid cars, measured in terms of motorcycles,

Figure 2.4According to Figure 2.4, as the economy moves from Point D to Point B, the opportunity cost of hybrid cars, measured in terms of motorcycles,

A. initially increases, then decreases. B. increases. C. remains constant. D. decreases.