If you were to face a marginal tax rate of 20 percent, how much would your tax bill increase when your income increased from $50,000 to $52,000?

A) $1,000

B) $400

C) $450

D) $10,400

Answer: B

You might also like to view...

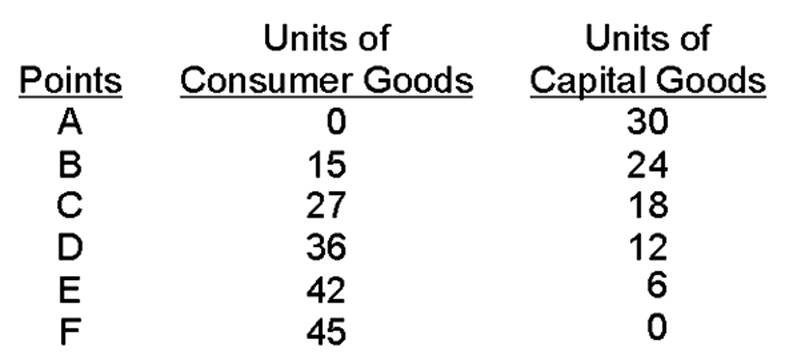

If the economy is producing at point B, the opportunity cost of gaining 12 units of consumer goods is _______ units of capital goods.

The working-age population can be divided into two groups

A) people in the labor force and people looking for work. B) people in the labor force and people with a job. C) people looking for work and those in the armed forces. D) people in the labor force and people who are not in the labor force.

All of the following have been proposed as explaining the limited effectiveness of monetary policy during and after the Financial Crisis of 2007-2009 EXCEPT:

A) recessions accompanied by financial crises tend to be severe B) a high level of uncertainty due in part to government policy C) the reluctance of the Fed to implement nonconventional policies D) structural changes as important sectors of the economy were deeply affected by the financial crisis

Which of the following would cause an increase in demand for Toyota automobiles?

a. an increase in the price of Toyota automobiles b. a decrease in the price of Toyota automobiles c. a decrease in the price of Honda automobiles d. an increase in the price of Honda automobiles