Assume that the following are the predicted inflation rates in these countries for the year: 2% for the United States, 3% for Canada; 4% for Mexico, and 5% for Brazil

According to the purchasing power parity and everything else held constant, which of the following would we expect to happen? A) The Brazilian real will depreciate against the U.S. dollar.

B) The Mexican peso will depreciate against the Brazilian real.

C) The Canadian dollar will depreciate against the Mexican peso.

D) The U.S. dollar will depreciate against the Canadian dollar.

A

You might also like to view...

When economic profits are positive, accounting profits could be:

A. negative. B. zero. C. positive. D. All of these are possible.

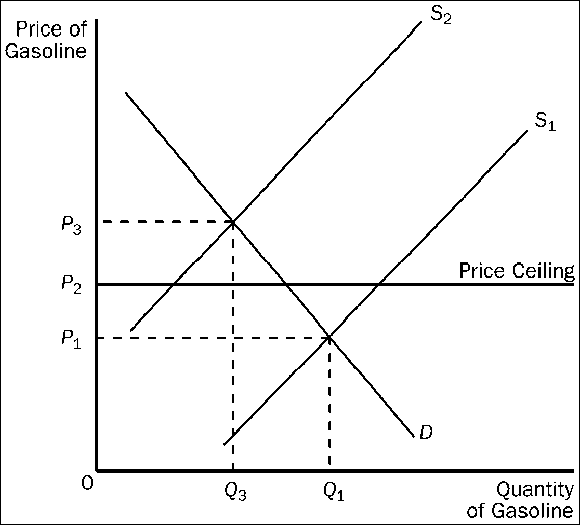

Figure 4-19

Refer to . When the price ceiling applies in this market and the supply curve for gasoline shifts from S1 to S2, the resulting quantity of gasoline that is bought and sold is

a.

less than Q3.

b.

Q3

c.

between Q1 and Q3.

d.

at least Q1.

If the marginal propensity to save (MPS) is 0.25, the value of the spending multiplier is:

A. 1. B. 2. C. 4. D. 9.

The figure below presents information for a one-shot game.Firm AFirm B??Low PriceHigh Price?Low Price(2,2)(10,-8)?High Price(-8,10)(6,6)What are the Nash equilibrium strategies for firm A and B respectively?

A. (high price, low price) B. (low price, low price) C. (high price, high price) D. (low price, high price)