Jennifer lives in two periods. In the first period, her income is fixed at $72,000; in the second, she is gets a 4% raise in her income. She can borrow and save at the market interest rate of 5 percent.

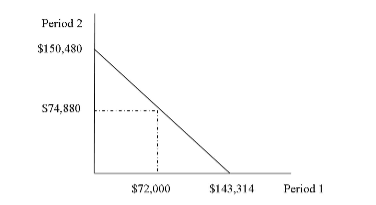

(A) Sketch her intertemporal budget constraint.

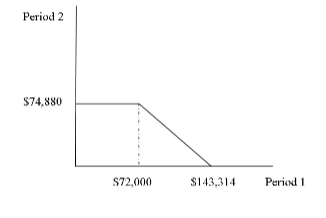

(B) Suppose that Jennifer is unable to lend at any rate of interest, although she can still borrow

at 5 percent. Sketch her new intertemporal budget constraint.

(A) Her income for the second year is 72,000 * 1.04 = $74,880.

If she borrows in Period 1 for the amount she will earn in Period 2, her total income is [72,000

+ (74,880/1.05)] = $143,314

If she lends in Period 1 for the amount she will earn in Period 1, her total income in period 2 is

[(72,000 * 1.05) + 74,880] = $150,480

Her intertemporal budget constraint is as follows:

(B) If she cannot lend at market rate, her Period 2 income is constant at $74,880. However,

she can borrow at 5 percent. Therefore her new intertemporal budget constraint is as follows:

You might also like to view...

Assume a market is in equilibrium. There is an increase in supply, but no change in demand As a result the equilibrium price ________, and the equilibrium quantity ________

A) rises; increases B) rises; decreases C) rises; does not change D) falls; decreases E) falls; increases

If the quantity desired of something exceeds the amount available at zero price, that item is called

A) capital. B) an economic good. C) an intangible good. D) a bad.

Marginal cost is the

a. change in total cost resulting from the purchase of one more unit of the variable input. b. change in total cost resulting from the production of one more unit of output. c. difference between total fixed cost and total variable cost. d. difference between total cost and total expenditure.

In which decade was the poverty rate steady?

a. 1960s b. 1970s c. 1990s d. 2000s