Rapid application development, the unified process, extreme programming, and scrum have led to ________

A) joint application development

B) dynamic systems development model

C) agile development

D) systems development life cycle (SDLC)

C

You might also like to view...

On January 1, 20X2, Pint Corporation acquired 80 percent of Size Corporation for $200,000 cash. Size reported net income of $25,000 each year and dividends of $5,000 each year for 20X2, 20X3, and 20X4. On January 1, 20X2, Size reported common stock outstanding of $160,000 and retained earnings of $40,000, and the fair value of the noncontrolling interest was $50,000. It held land with a book value of $90,000 and a market value of $100,000, and equipment with a book value of $40,000 and a market value of $48,000 at the date of combination. The remainder of the differential at acquisition was attributable to an increase in the value of patents, which had a remaining useful life of eight years. All depreciable assets held by Size at the date of acquisition had a remaining economic life of

eight years. Pint uses the equity method in accounting for its investment in Size.Based on the preceding information, the increase in the fair value of patents held by Size is A. $18,000 B. $32,000 C. $10,000 D. $50,000

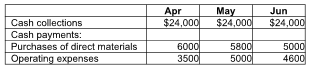

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, calculate the projected cash balance at the end of April.

Clyde, Inc. has a cash balance of $20,000 on April 1. The company is now preparing the cash budget

for the second quarter. Budgeted cash collections and payments are as follows:

Which of the following is the biggest problem with simulated test markets?

A. They can be used only in the commercialization stage and not in the product development stage. B. They cannot be computer-generated. C. They do not always reflect actual buying behavior. D. They make it easy for competitors to "steal" one's ideas.

Davis Hardware Company uses a periodic inventory system. How should Davis record the sale of inventory costing $620 for $960 on account?1.Cost of Goods Sold620 Purchases 620 Accounts Receivable960 Sales Revenue 9602.Accounts Receivable960 Sales Revenue 9603.Purchases620 Gain340 Sales Revenue 9604.Accounts Receivable960 Sales Revenue 620 Gain 340

A. Option 1 B. Option 2 C. Option 3 D. Option 4