Real estate values derive from the interaction of three different sectors in the economy. Which of the following sectors serves to allocate financial resources among households and firms requiring funds?

A. User market

B. Capital market

C. Government

D. Property market

Answer: B. Capital market

You might also like to view...

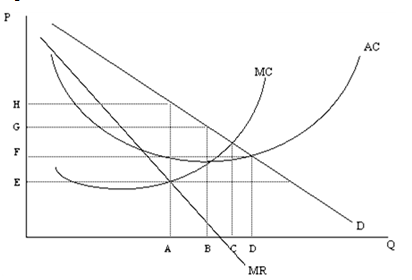

Figure 11-2

A. A B. B C. C D. D

Assume that the expectation of a recession next year causes business investments and household consumption to fall, as well as the financing to support it. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the real GDP and net nonreserve international borrowing/lending balance in the context of the Three-Sector-Model? a. Real GDP falls

and net nonreserve international borrowing/lending balance becomes more negative (or less positive). b. Real GDP rises and net nonreserve international borrowing/lending balance becomes more negative (or less positive). c. Real GDP falls and net nonreserve international borrowing/lending balance becomes more positive (or less negative). d. Real GDP falls and net nonreserve international borrowing/lending balance falls. e. There is not enough information to determine what happens to these two macroeconomic variables.

Other things remaining constant, the only way to move along a given supply curve for a product is for:

a. Technological changes to occur b. The number of sellers to increase or decrease c. The price of resources used to produce the product to increase or decrease d. The product's price to increase or decrease

The change in saving divided by the change in income is the:

A. marginal propensity to save. B. saving function. C. average propensity to save. D. extra propensity to save.