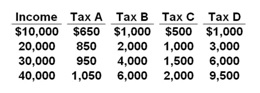

Answer the question on the basis of the following four tax schedules for the given base of taxable income. Which of the above tax schedules is a proportional tax schedule throughout?

A. A

B. B

C. C

D. D

C. C

You might also like to view...

What causes the market supply curve to shift rightward?

a. Increase in the aggregate demand b. Decrease in the number of existing firms c. Decrease in the price level d. Increase in the cost of production e. Entry of new firms

In the early 2000s, some argued that the Indian government impeded foreign investment with tariffs, investment caps, and tons of red tape. In terms of promoting or retarding economic growth, such policies:

A. increase growth because they keep people producing for the local market. B. decrease growth because they slow the growth of capital. C. increase growth because they stop exploitation by foreigners. D. decrease growth because they cause inflation.

There is no incentive for additional producers of an information product to enter the industry when the price charged for these products by each firm already in the industry is equal to

A) marginal cost. B) average total cost. C) average fixed cost. D) average variable cost.

To offset the indirect crowding-out effects, a government engaging in expansionary policy aimed at eliminating a recessionary gap could

A. reduce taxes rather than increase government spending. B. both reduce taxes and reduce spending to be able to achieve full employment. C. increase spending more than the simplest Keynesian model would predict. D. increase spending less than the simplest Keynesian model would predict.