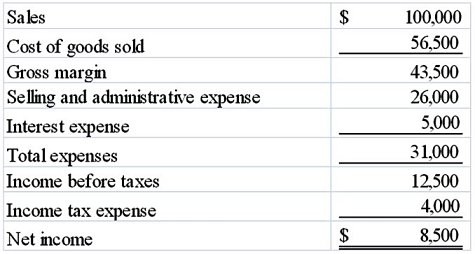

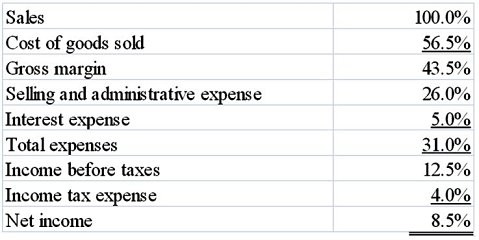

The following income statement was prepared by Case Company for Year 2: Required:Perform vertical analysis for Case Company's Year 2 income statement.

Required:Perform vertical analysis for Case Company's Year 2 income statement.

What will be an ideal response?

You might also like to view...

On July 1 . 2014, Saunter issued 2,000 of its 8 percent, $1,000 bonds for $1,752,000 . The bonds were issued to yield 1 . percent. The bonds are dated July 1 . 2014, and mature on July 1 . 2024 . Interest is payable semiannually on January 1 and July 1 . Using the effective-interest method, how much of the bond discount should be amortized for the six months ended December 31 . 2014?

a. $15,200 b. $12,400 c. $9,920 d. $7,600

Gerome has planned a distance presentation for new employees in his company's six locations. Since he has not previously met the participants in person, he should schedule a conference call with the participants to establish rapport prior to the distance presentation

Indicate whether the statement is true or false

Compared to corporations, what is the primary disadvantage of partnerships as a form of business organization?

A. The tax rates applied to partnerships are higher than the tax rates applied to corporations. B. Any dividends paid to the owners of a partnership business are taxed twice, once at the partnership level and once at the personal, or individual level. C. Partnerships generally are more complex to form (start up) than corporations. D. Partnerships have unlimited lives whereas corporations do not. E. The owners of a partnership, that is, the partners, have unlimited liability when it comes to business obligations whereas the owners of a corporation have limited liability.

The expected value of perfect information (EVPI) places a lower bound on how much a decision maker should be willing to pay to obtain perfect information

Indicate whether the statement is true or false