You have a bond that pays $18 per year in coupon payments. Which of the following would result in a decrease in the price of your bond?

A) The likelihood that the firm issuing your bond will default on debt decreases.

B) Coupon payments on newly-issued bonds rise to $22 per year.

C) The price of a share of stock in the company rises.

D) Coupon payments on newly-issued bonds fall to $15 per year.

B

You might also like to view...

In the above figure, the economy is initially at point B. If the government decreases transfer payments, there is

A) a movement to point C. B) a movement to point A. C) a shift to AD2. D) a shift to AD1.

Private capital flows in the form of both direct and portfolio investment began to return to Latin America after 1989, effectively marking the end of the Lost Decade

Indicate whether the statement is true or false

The market for toothpaste is a good example of perfect competition

a. True b. False Indicate whether the statement is true or false

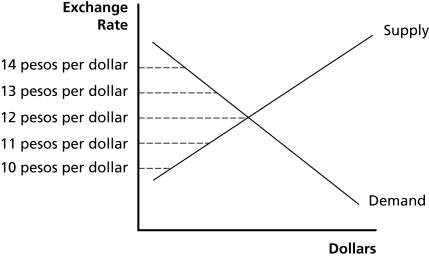

Referring to Figure 18.2, the peso is likely to appreciate if the exchange rate is either ________ or ________ pesos to the dollar.

Referring to Figure 18.2, the peso is likely to appreciate if the exchange rate is either ________ or ________ pesos to the dollar.

A. 10; 11 B. 11; 12 C. 12; 13 D. 13; 14