The advantage of imposing a tax on the producer that generates pollution is that

A) it will eliminate pollution.

B) the government can keep tabs on exactly what is produced in an industry.

C) a producer can pass the cost of pollution to the victims of the pollution.

D) it forces the polluting producer to internalize the external cost of the pollution.

D

You might also like to view...

When the good on the horizontal axis is a composite good, the slope of the budget constraint is minus the price of the good on the vertical axis.

Answer the following statement true (T) or false (F)

The concept of "the invisible hand" suggests that markets

A) do not produce the efficient quantity. B) are always fair. C) produce the efficient quantity. D) are unfair. E) allocate resources unfairly and inefficiently.

"Creating a free market for carbon-dioxide emission permits would only encourage firms to pollute more." Do you agree or disagree? Why?

What will be an ideal response?

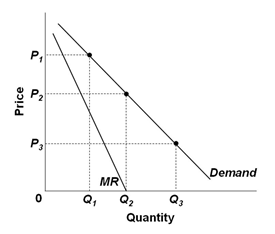

Refer to the graphs below of D and MR for a monopolist. Which of the following statements is true?

A. A price cut from P1 to P2 would lead to a decrease in consumer spending on the product

B. A price cut from P1 to P2 would lead to an increase in consumer spending on the product

C. A price cut from P2 to P3 would lead to no change in consumer spending on the product

D. A price cut from P2 to P3 would lead to an increase in consumer spending on the product