Although the word "better" is normally accepted as puffery, the word "best" is somewhat vague and implies a comparison, which has recently been tested through the FTC

Indicate whether the statement is true or false

FALSE

You might also like to view...

A cultural production system is a ________

A) creative subsystem B) managerial subsystem C) communication subsystem D) all of the above

________ is an open source database that can store and analyze both structured and unstructured data.

A. ASP B. PHP C. Hadoop D. JSP

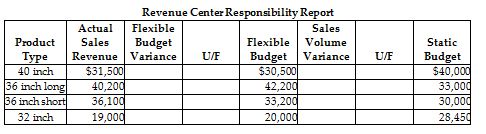

Vasquez Construction Materials Company has a sales office that sells concrete culvert pipes to property developers. The sales office is a revenue center and prepares a monthly responsibility report. The following information is provided.

What is the sales volume variance for the 36-inch long pipe?

A) $2000 U

B) $9200 F

C) $9500 U

D) $1000 F

Warrior Dash Express Inc owns a moving van that originally cost $500,000 and currently has $450,000 of accumulated depreciation. The fair value of the moving van is $120,000 . Warrior Dash Express Inc exchanges the van plus $480,000 in cash for a new moving van costing $600,000 . The entry to record the transaction is as follows:

a. Equipment (new van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 600,000 Accumulated Depreciation (old van) . . . . . . . . . .. . . . . . . . . .450,000 Equipment (old van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500,000 Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 480,000 Gain on Trade-in of Old Van . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70,000 b. Equipment (new van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 600,000 Accumulated Depreciation (old van) . . . . . . . . . .. . . . . . . . . .450,000 Equipment (old van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 570,000 Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 480,000 c. Equipment (new van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 600,000 Accumulated Depreciation (old van) . . . . . . . . . .. . . . . . . . . .380,000 Equipment (old van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500,000 Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 480,000 d. Equipment (old van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500,000 Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 480,000 Gain on Trade-in of Old Van . . . . . . . . . . . . . . . . . . . . . . . . . . . 70,000 Equipment (new van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 600,000 Accumulated Depreciation (old van) . . . . . . . . . . . . . . . . . . . . . . . . . 450,000 e. Equipment (old van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 570,000 Cash . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 480,000 Equipment (new van) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 600,000 Accumulated Depreciation (old van) . . . . . . . . . .. . . . . . . . . . . . . . . . 450,000