Since the early 1980s, the real exchange rate between U.S. goods and Japanese goods has climbed, relative to the nominal exchange rate (yen/U.S. dollar). What does this imply about economic conditions in the two countries?

What will be an ideal response?

Any change in the real exchange rate relative to the nominal exchange rate reflects a change in the relative price levels. The real exchange rate trends higher when domestic (U.S.) inflation is higher than foreign inflation. Lower inflation in Japan suggests that its economy has been generally weaker and growing more slowly than the U.S. economy.

You might also like to view...

For an individual who has special talent as an entertainer, a large proportion of his salary can be considered

A) a fixed cost. B) economic rent. C) a payment below opportunity cost. D) non-taxable income.

Which of the following would NOT be a part of personal income?

A. retirement checks B. indirect business taxes C. corporate dividend payments to shareholders D. payments received from Social Security

How do co payments and deductibles help contain health care costs?

What will be an ideal response?

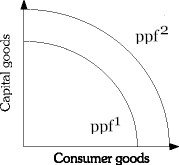

Refer to the information provided in Figure 2.6 below to answer the question(s) that follow. Figure 2.6Refer to Figure 2.6. An increase in the economy's capital stock is represented by a

Figure 2.6Refer to Figure 2.6. An increase in the economy's capital stock is represented by a

A. shift from ppf1 to ppf2. B. movement along ppf2. C. shift from ppf2 to ppf1. D. movement along ppf1.