Discuss the similarities and differences among a sole proprietorship, partnership,

and corporation

What will be an ideal response?

The sole proprietor puts up the capital, hires and directs all employees, reaps all profits,

absorbs all losses, and is personally and totally responsible for all debts. There is no

separation between the sole proprietor's personal finances and those of the business. A

partnership is a business engaged in by two or more persons who have signed an

agreement. Usually, each partner contributes the same amounts of capital and divides

the work equally. They each draw the same weekly salary, and at the end of the year

they divide the profits equally. Both partners become liable for the actions of either

partner. Finally, a corporation is the most public method of doing business and more

governed by state and federal laws than are sole proprietorships or partnerships. The

corporation is a legal entity, separate from its owner and managers. The profits of the

corporation are taxed independently of the incomes of the company's owners. The

liabilities of the corporation are also legally separate from the personal debts of its

owners. A corporation can file or be the defendant in a lawsuit without affecting the

personal finances of the owners.

You might also like to view...

What is a system designed to control the temperature of steam leaving a boiler by using water injection through a control valve?

A) Risers B) Downcomers C) Superheater D) Desuperheater

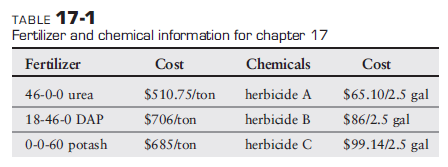

Ms. Hill owns The Community Super Market that buys and sells farm produce. She had a contract with Jim to supply the market with 3,500 bushels of corn with 5 percent small grain or less at $6.55 per bushel. Jim delivered 4,280 bushels with 6.5 percent small grain. Jim was docked 0.5 percent for each percentage point over 5 percent small grain. For corn not under contract with 5 percent small grain or less Ms. Hill paid $6.10 per bushel. Jim placed an order for 175-85-80 units of fertilizer per acre to be applied to 545 acres. He also ordered herbicide A to be applied at 1.2 quarts per acre, herbicide B at 1.3 quarts per acre, and herbicide C at 1.5 quarts per acre. Ms. Hill filled the order from the items in Table 17-1.

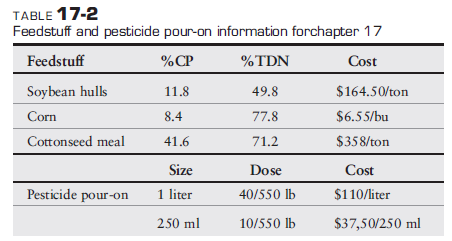

Jim bought 240 steers weighing 475 pounds. He placed an order with The Community Super Market for a ton of a balanced ration of 16 percent CP and 68 percent TDN. He ordered pesticide pour-on for internal worm and lice control. The items given in Table 17-2 were used to fill the order.

a. What did The Community Super Market pay Jim for his corn?

b. What was the cost of Jim’s fertilizer and herbicide?

c. What was the cost of Jim’s feed and pesticide pour-on? (Note: Find his better buy on pesticide pour-on keeping in mind that he must buy the whole container.)

Other than food, what other products come from the animal industry?

A) sulfates B) medicines? C) fibers D) chemicals

Where do catfish lay their eggs in the wild, and what do producers do to simulate this structure?

What will be an ideal response?