When the government taxes income as part of a redistribution program,

a. the poor pay higher taxes.

b. the rich always benefit more than the poor.

c. the poor are encouraged to work.

d. incentives to earn income are diminished.

d

You might also like to view...

The value that society places on consumption that is sacrificed in the present is called

A. social marginal costs. B. social marginal damages. C. social rate of discount. D. social returns.

The natural rate of unemployment:

A. can vary over time and will differ across countries. B. can vary over time but tends to be the same across countries. C. tends to remain constant over time but at different levels for different countries. D. tends to remain constant over time and is the same across countries.

Which of the following results if at a particular price level, the aggregate quantity supplied exceeds the aggregate quantity demanded?

A. Aggregate demand shifts to the right. B. A surplus causes the price level to fall. C. Aggregate supply shifts to the left. D. A surplus causes the price level to rise.

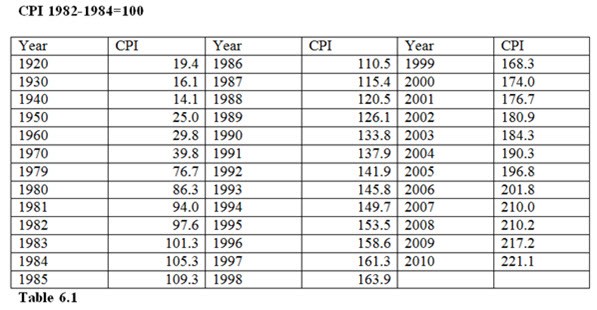

Using Table 6.1, the inflation rate for 2004 would be

A. 3.3% (((190.3-184.3)/184.3)*100 %). B. 90.3% (190.3-100). C. 6.0% (190.3-184.3). D. 2.6% (190.3-180.9)/(2*180.9)*100%).