The net method of recording purchases refers to recording:

A. Inventory at the lower of cost or market.

B. Purchases at the full invoice price, without deducting any cash discounts.

C. Specified amounts and timing of payments that a buyer agrees to in return for being granted credit.

D. Inventory at its selling price.

E. Purchases at the invoice price less any cash discounts.

Answer: E

You might also like to view...

Which of the following is not a correct statement regarding deferred tax asset valuation allowance?

A. Companies without a history of profitability may generate negative income tax expense in the year they first generate a profit if they have a valuation allowance that is reversed in the year of profitability. B. Profitable companies will never have valuation allowances against deferred tax assets. C. If a deferred tax asset may not be fully realized in future periods, a valuation allowance is required to reduce the asset to the amount that is more likely than not to be realized. D. The determination of whether or not a valuation allowance is necessary is based on subjective assessment.

Which of the following statements is TRUE, if the sales volume increases by 10%?

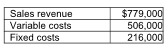

Waterproof Roofing Company has provided the following information:

A) Operating income will increase by $50,600.

B) Operating income will increase by $27,300.

C) Fixed expenses will increase by $21,600.

D) Contribution margin will increase by $77,900.

In 2012, women were more likely than men to marry someone with less education

Indicate whether the statement is true or false

A mark that indicates that a person has met the standards set by an organization and is a member of that organization is known as a(n) ________ mark

A) collective membership B) certification C) service D) ownership