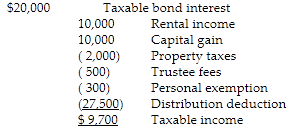

The trust must distribute all of its income annually. Calculate taxable income after the distribution deduction.

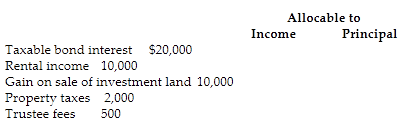

A trust reports the following results:

Verification of this amount is possible by subtracting the personal exemption ($300) from the capital gain ($10,000) to arrive at taxable income ($9,700).

You might also like to view...

A major disadvantage of comparative scales would be which of the following?

A) Halo or carryover effects are reduced. B) Respondents bring the same point of reference to a task. C) The resulting data measures relative differences. D) Only big differences between objects can be detected. E) A researcher cannot generalize beyond the objects under study.

Research of which approach to authentic leadership was conducted using interviews of successful leaders?

A. George’s practical model B. Luthans and Avolio’s practical model C. Luthans and Avolio’s theoretical model D. Walumbawa’s positive psychology model

Discuss standard costing. As part of your discussion, define a standard cost. In addition, compare and contrast standard costs and predetermined overhead costs. Include in your discussion at least three reasons why standard costs are introduced into a cost accounting system. How is a standard cost accounting system useful to management?

______ act like health maintenance organizations in that they prefer that you have a primary care physician within their medical network and that you go to that primary care physician before going elsewhere for medical care.

A. Primary care physicians B. Unemployment insurers C. Preferred provider organizations D. Worker’s compensation plans