In a market with a downward-sloping demand curve and an upward-sloping supply curve, a law requiring sellers to pay the government a tax of $1.00 per pack on cigarettes has the effect of:

A. shifting the supply curve to the right and increasing the price buyers pay by $1.00.

B. shifting the demand curve to the right and increasing the price buyers pay by $1.00.

C. shifting the supply curve to the left and increasing the price buyers pay by less than $1.00.

D. shifting the demand curve to the left and increasing the price buyers pay by less than $1.00.

Answer: C

You might also like to view...

If lenders anticipate no changes in liquidity, information costs, and tax differences, the yield on a risky security should be

A) greater than that on a safe security and the price of a risky security should also be greater than that of a safe security. B) less than that on a safe security and the price of a risky security should also be less than that of a safe security. C) greater than that on a safe security and the price of a risky security should be lower than that of a safe security. D) less than that on a safe security and the price of a risky security should be greater than that on a safe security.

Explain briefly the vent-for-surplus theory of international trade. What is the relevance of this theory to the current development experience of low-income economies?

What will be an ideal response?

Corruption is only present in developing nations

Indicate whether the statement is true or false

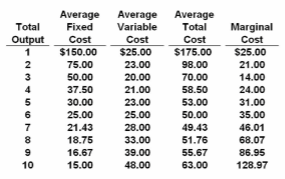

Refer to the data. At 6 units of output, total fixed cost is ____ and total cost is ____.

A. $25; $50

B. $50; $300

C. $100; $200

D. $150; $300