The people most likely to pay little personal income tax to the U.S. government are

A. the middle class.

B. renters.

C. the very poor.

D. earners of wages (as opposed to salaries).

Answer: C

You might also like to view...

Which of the following is NOT studied in microeconomics?

A) the effect of an increase in gasoline taxes on the purchase of gasoline B) the impact of an increase in the unemployment rate on economic production C) the impact of firms' collective hiring choices on the aggregate unemployment rate D) the impact of higher fuel prices on the cost of airline tickets

Within the city of New Orleans, most of the victims of Hurricane Katrina were

A. rich and white. B. rich and black. C. poor and white. D. poor and black.

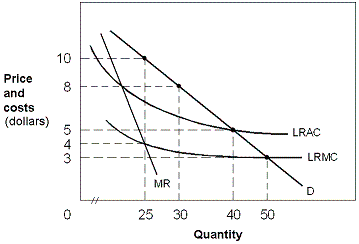

Exhibit 13-3 A monopolist

A. this firm would earn excess profit. B. total revenue would equal marginal revenue. C. the firm would suffer losses. D. revenue would just be sufficient to cover costs.

The standard discussion of monetary policy is based on the assumption that the:

A. entire yield curve shifts up when the Fed sells government bonds. B. yield curve becomes steeper when the Fed buys government bonds. C. entire yield curve shifts down when the Fed sells government bonds. D. yield curve becomes inverted when the Fed buys government bonds.