A firm considering whether to borrow money to purchase a capital good will compare the rate of interest for the loan with the:

A. Opportunity cost of the capital good

B. Rate of return on the investment

C. Length of the investment

D. Treasury bill rate

B. Rate of return on the investment

You might also like to view...

The short-run supply curve for a perfectly competitive firm is its marginal cost curve

A) above the horizontal axis. B) above its shutdown point. C) below its shutdown point. D) everywhere.

If the Fed wanted to stimulate the economy to limit the effects of a recessionary gap, then it should ________ the federal funds rate in order to ________ the real interest rate and thereby ________ investment.

Fill in the blank(s) with the appropriate word(s).

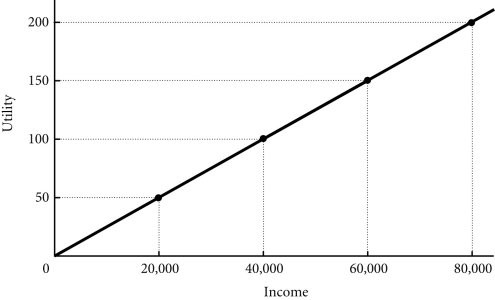

Refer to the information provided in Figure 17.2 below to answer the question(s) that follow.  Figure 17.2 Refer to Figure 17.2. Suppose Sam's utility from income is given in the diagram. From this we would say that Sam is

Figure 17.2 Refer to Figure 17.2. Suppose Sam's utility from income is given in the diagram. From this we would say that Sam is

A. a risk taker. B. risk-loving. C. risk-neutral. D. risk-averse.

Conservatives and liberals ___ on the causes of poverty and ___ on how to solve the poverty problem.

A. agree; agree B. agree; disagree C. disagree; agree D. disagree; disagree