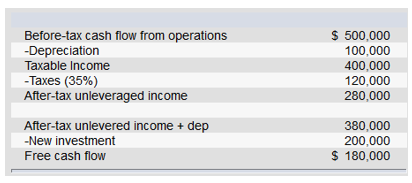

Consider the free cash flow approach to stock valuation. Utica Manufacturing Company is expected to have before-tax cash flow from operations of $500,000 in the coming year. The firm's corporate tax rate is 30%. It is expected that $200,000 of operating cash flow will be invested in new fixed assets. Depreciation for the year will be $100,000. After the coming year, cash flows are expected to grow at 6% per year. The appropriate market capitalization rate for unleveraged cash flow is 15% per year. The firm has no outstanding debt. The total value of the equity of Utica Manufacturing Company should be

A. $1,000,000.

B. $2,000,000.

C. $3,000,000.

D. $4,000,000.

B. $2,000,000.

Projected free cash flow = $180,000; V0 = 180,000/(.15 .06) = $2,000,000.

You might also like to view...

If the balance shown on a company's bank statement is less than the correct cash balance, and neither the company nor the bank has made any errors, there must be

a. deposits credited by the bank but not yet recorded by the company. b. outstanding checks. c. bank charges not yet recorded by the company. d. deposits in transit.

Many firms disaggregate the initial amounts they received from shareholders for common shares into the par or nominal or stated value of the shares and the amounts received in excess of this value, called:

a. additional paid-in capital (APIC). b. share premium. c. capital contributed in excess of par value. d. Choices a, b, and c are correct. e. None of these answer choices is correct.

Graham Pottery Inc Graham Pottery Inc produces an item that gives rise to the following activities: Activity Hours Processing (two departments) 30 Inspecting 3 Rework 2 Moving (three moves) 9 Waiting (for the second process) 9 Storage (before delivery to the customer) 8 Refer to the Graham Pottery Inc information above. The total manufacturing cycle time is:

A) 61 hours. B) 30 hours. C) 65 hours. D) 44 hours.

What is the general concept of the fresh start in bankruptcy?

A) Creditors are given a new start in collecting amounts owed to them. B) Debtors are given a new start in paying off their existing debts. C) Businesses adopt a new plan of business. D) Debtors have most debts discharged and start over without those debts.