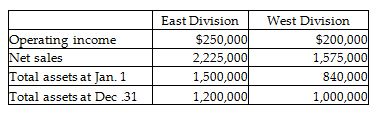

The following is divisional information for Randolph Enterprises:

The target rate of return is 12% for the East Division and is 10% for the West Division.

Compute the return on investment for each division. (Round to one decimal place.)

Average assets: (Beginning assets + Ending assets) / 2

East Division = ($1,500,000 + $1,200,000) / 2

= $2,700,000 / 2

= $1,350,000

West Division = ($840,000 + $1,000,000) / 2

= $1,840,000 / 2

= $920,000

Return on investment = Operating income / Average total assets

East Division = $250,000 / $1,350,000

= 18.5%

West Division = $200,000 / $920,000

= 21.7%

You might also like to view...

Answer the following statements true (T) or false (F)

1) Freight in is a delivery expense to the seller. 2) Freight charges to ship goods to customers is recorded as a debit to Delivery Expense. 3) A merchandiser adjusts and closes accounts differently than a service entity does. 4) Merchandisers must adjust for estimated sales returns and inventory shrinkage. 5) The loss of inventory that occurs because of theft, damage, and errors is referred to as inventory shrinkage.

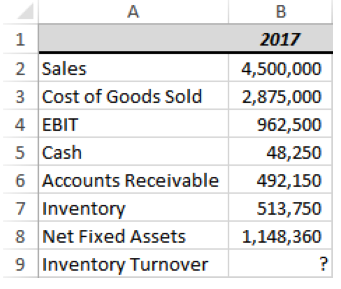

What should be the formula in cell B9?

a) =B7/B3

b) =B3/B7

c) =B4/B7

d) =B7/B2

e) None of the above

"I'll sell you my car if I decide to sell it" is an example of:

a. a conditional offer. b. an unliquidated offer. c. a unilateral contract. d. an illusory promise.

Keeping the technology proprietary is accomplished through

A. contracted development. B. licensing. C. internal development. D. joint venture. E. technology trading.