Summing up governmental intervention in the pricing of goods, we can say it

a. occurs only under wartime conditions

b. has grown considerably during the past two decades and now characterizes the majority of our markets

c. has peaked in the 1970s and now has only a shadow of its former influence

d. occurs in relatively few markets because most market prices are determined by the forces of demand and supply

e. occurs only in the production of farm goods

D

You might also like to view...

When used in a professional or technical sense, the law of supply and demand refers to

A. some vague influences on economic affairs. B. the fact that prices go up when commodities are scarce. C. the market forces that show how prices and quantities are determined. D. the controls that regulate the amount of scarce goods that each consumer can purchase.

According to proponents of the interest-rate-based monetary policy transmission mechanism, any increase in the money supply

A) causes velocity to increase, and so in the short run nominal Gross Domestic Product (GDP) must increase. B) will increase Gross Domestic Product (GDP) only if interest rates fall and investment is sensitive to decreasing interest rates. C) is effective in increasing Gross Domestic Product (GDP) only if it causes an outward shift of the aggregate supply curve. D) will move the economy from the "liquidity trap" during times of recession if interest rates fall enough to stimulate private investment.

Answer the next question based on the following balance sheet for the First National Bank. Assume the reserve ratio is 15 percent.AssetsLiabilities & Net WorthReserves$50,000 Checkable Deposits$120,000Loans75,000 Stock Shares130,000Securities25,000 Property100,000?Refer to the above data. This bank can make new loans of up to:

A. $32,000. B. $41,000. C. $50,000. D. $27,000.

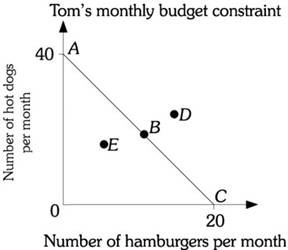

Refer to the information provided in Figure 6.1 below to answer the question(s) that follow. Figure 6.1Refer to Figure 6.1. Assume Tom is on budget constraint AC and the price of a hamburger is $8.00. Tom's monthly income is

Figure 6.1Refer to Figure 6.1. Assume Tom is on budget constraint AC and the price of a hamburger is $8.00. Tom's monthly income is

A. $2.50. B. $20. C. $80. D. $160.