Solve the problem. Assume that simple interest is being calculated in each case. Round your answer to the nearest cent.John forgot to pay his $413.00 income tax on time. The IRS charged a penalty of 3% for the 35 days the money was late. Find the penalty that was paid. (Use a 365 day year.)

A. $1.19

B. $414.19

C. $0.14

D. $1.15

Answer: A

Mathematics

You might also like to view...

Solve the problem.The difference in length between the minimum spanning tree and the shortest network is

A. always less than 5%. B. 0. C. always greater than 0. D. always less than 13.4%. E. none of these

Mathematics

Convert the degree measure to radians, correct to four decimal places. Use 3.1416 for ?.83.88°

A. 1.2640 B. 1.3640 C. 1.5640 D. 1.4640

Mathematics

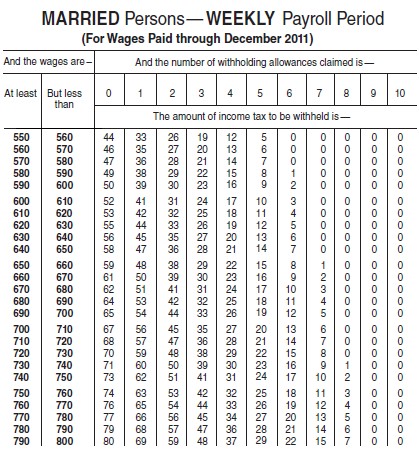

Find the federal withholding tax for the employee. Use the wage bracket method.  Employee Married? Allowances Earnings Schaefer, D. yes 2 $583.48 weekly

Employee Married? Allowances Earnings Schaefer, D. yes 2 $583.48 weekly

A. $26 B. $27 C. $28 D. $29

Mathematics

Multiply and simplify. ?

?

A.

B.

C.

D.

Mathematics