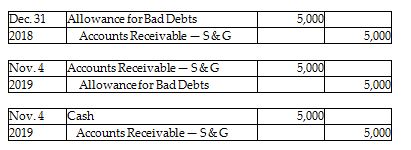

On July 15, 2018, Ellison Brothers Oil Company sold $5,000 of merchandise to S & G Company, on account. Ignore cost of goods sold. Ellison could not collect cash from S & G and wrote off the account on December 31, 2018. On November 4, 2019, S & G unexpectedly paid $5,000. Journalize the transactions on December 31, 2018 and November 4, 2019. (Ellison uses the allowance method.) Omit explanations

You might also like to view...

Customer-perceived value is defined as the customer's evaluation of the difference between all the benefits and all the costs of a market offering relative to those of competing offers

Indicate whether the statement is true or false

Chronologically, the first part of the master budget to be prepared would be the

a. sales budget. b. production budget. c. cash budget. d. pro forma financial statements.

Fewer employees seem to be desirous of job-related growth opportunities now than was the case several years ago

Indicate whether the statement is true or false.

Certain balance sheet accounts of a foreign subsidiary of Parker Company at December 31, 2018, have been restated into U.S. dollars as follows: Restated at Current Rates Historical RatesCash$47,500 $45,000 Accounts receivable 95,000 90,000 Marketable securities, at fair value 76,000 72,000 Land 57,000 54,000 Equipment (net) 142,500 135,000 Total$418,000 $396,000 ?Assuming the functional currency of the subsidiary is the U.S. dollar, what total should be included in Parker's consolidated balance sheet at December 31, 2018, for the above items?

A. $407,500. B. $396,000. C. $403,500. D. $418,000. E. $398,500.