Solve the problem. Assume no employee earned over $110,000. Use a FICA rate of 6.2%, a Medicare rate of 1.45%, and a FUTA rate of 6.0% of the first $7000 in earnings.Frank Johnson received $3525 in earnings in the first quarter and $7547 in the second quarter. Find the amount of his earnings subject to FUTA and the amount of tax due in the second quarter.

A. $3475, $208.50

B. $3480, $218.93

C. $3475, $215.45

D. $3475, $211.98

Answer: A

You might also like to view...

Find the constant that should be added to the expression to make it a perfect square.x2 -  x + ?

x + ?

A.

B.

C.

D.

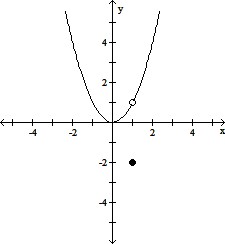

The figure shows the graph of a function. At the given value of x, does the function appear to be differentiable, continuous but not differentiable, or neither continuous nor differentiable?x = 1

A. Differentiable B. Continuous but not differentiable C. Neither continuous nor differentiable

Find the first five partial sums of the given series and determine whether the series is convergent or divergent. If it is convergent, then find its sum.1 + 3 + 5 + 7 + 9 + ...

A. 1, 4, 8, 12, 16; divergent B. 1, 3, 5, 7, 9; divergent C. 1, 4, 9, 16, 25; divergent D. 4, 9, 16, 25, 36; divergent

Write the fraction in lowest terms.

A.

B.

C.

D.