Suppose you are risk loving and you are deciding between two investments. One has a guaranteed return of 5% while the second has a 50% chance of a 10% return and a 50% chance of a 0% return. Which investment would you choose? Why?

What will be an ideal response?

The second investment has an expected return of (0.5 × 10%) + (0.5 × 0%) = 5%. Since the two investments have the same expected return and you are risk loving, you choose the second investment risk loving investors prefer to gamble on possibly earning a higher return.

You might also like to view...

What is the relationship between marginal cost and fixed cost?

What will be an ideal response?

What does it mean if an industry has external diseconomies?

What will be an ideal response?

Full employment occurs when the rate of unemployment consists of:

a. structural plus frictional unemployment. b. cyclical plus frictional unemployment. c. structural, frictional, and cyclical unemployment. d. none of these.

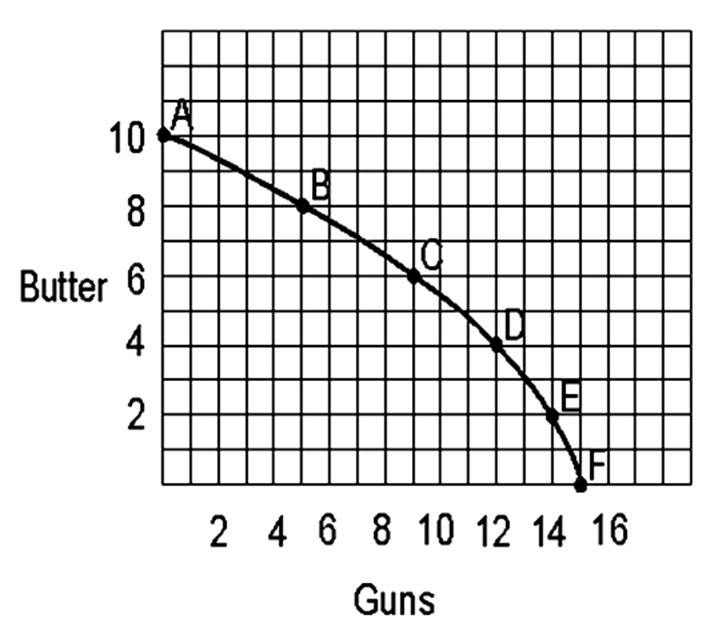

If the country represented in this graph now can produce a maximum of 12 units of guns if it shifts all resources to gun production and could produce a maximum of 9 units of butter if it used all its resources for butter production then it would have experienced __________________.