Assume that in year 1 you pay an average tax rate of 20 percent on a taxable income of $20,000. In year 2, you pay an average tax rate of 25 percent on a taxable income of $30,000. Assuming no change in tax rates, the marginal tax rate on your additional

$10,000 of income is:

A. 5 percent.

B. 12 percent.

C. 35 percent.

D. 42 percent.

Answer: C

You might also like to view...

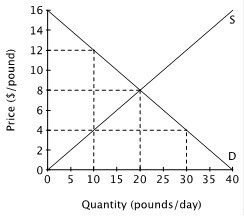

The figure below shows the supply and demand curves for oranges in Smallville.  At the price of $4 per pound, sellers offer ________ pounds of oranges per day, and buyers want to purchase ________ pounds of oranges a day.

At the price of $4 per pound, sellers offer ________ pounds of oranges per day, and buyers want to purchase ________ pounds of oranges a day.

A. 30; 10 B. 20; 20 C. 10; 20 D. 10; 30

Suppose a paper mill earns $1,000,000 in profits when it pollutes a river, and it can abate pollution at a cost of $A. The effects of the pollution are confined to a single farmer who earns $400,000 if the water he uses from the river is clean and $300,000 if it's polluted. If _______, then abatement would be efficient.

A. A < 300,000 B. A > 100,000 C. A < 100,000 D. A < 400,000

Ceteris paribus, if the market demand for a product decreases, then equilibrium quantity will (be) ____ and equilibrium price will (be) ____

a. increase; increase b. indeterminate; decrease c. indeterminate; increase d. decrease; decrease

Property rights are well established for

a. private goods. b. public goods. c. common resources. d. both (b) and (c).