Describe the characteristics of private capital flows to DVC.

What will be an ideal response?

DVCs receive flows of private capital from IAC. In 2010 the total flow of private capital to DVC was $557 billion. These flows mainly come from corporations and private investors, and not commercial banks. The flow of private investment and lending has largely been directed to selected nations such as China, Mexico, India, and other middle-income DVC. The flow can be variable because it depends on economic conditions, increasing during period of worldwide prosperity and decreasing during economic downturns. Many of the low-income DVC however, have a high debt burden from past government and private loans and struggle to repay both interest and principal on these loans. These expenditures divert resources in those nations from other important economic activity such as support for basic infrastructure or education.

You might also like to view...

Procyclical variables ________ during expansions and ________ during recessions

A) fall; fall B) rise; fall C) fall; rise D) rise; rise

Which of the following policies improves prospects for more rapid economic growth?

A) policies to increase government expenditure B) limitations on international trade C) policies to increase the educational attainment of the labor force D) encouragement of political instability

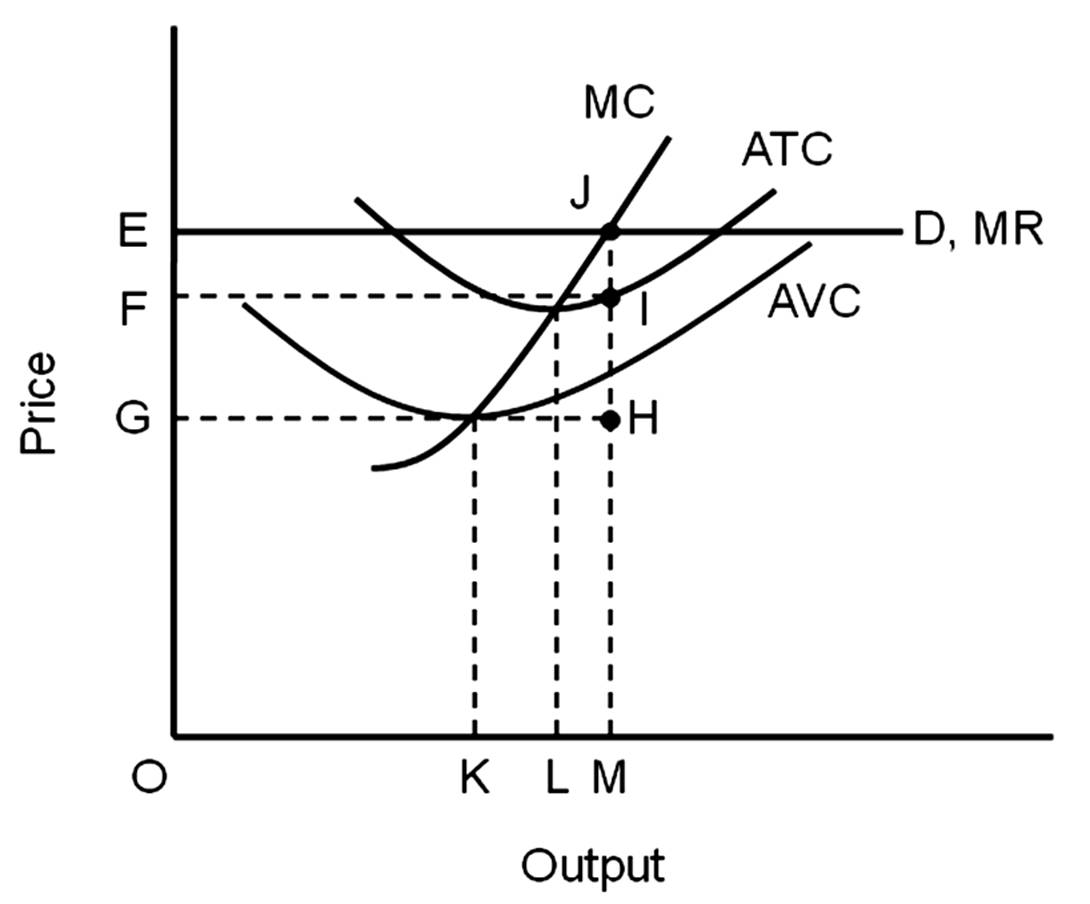

Which statement is true?

A. This firm is in the short run.

B. This firm is in the long run.

C. This firm may be in either the short run or the long run.

D. It cannot be determined if this firm is in the short run or the long run.

Suppose each of the 50 states had only one gasoline station, and all stations were the same size. The four-firm concentration ratio, based on national data, would be:

A. 0.32. B. 1.0. C. 0.16. D. 0.08.