Since the 1980s, mortgages allowing less than 20% down payment have appeared, requiring

A. both borrowers and lenders to hold each other harmless in case of default or physical damage.

B. lenders to insure the borrower against loss in case of default.

C. lenders to insure the borrower against physical damage to the house.

D. borrowers to insure the lender against loss in case of default.

Answer: D

You might also like to view...

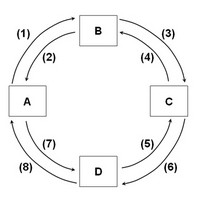

Use the following circular flow diagram to answer the question below. If box A represents businesses or firms, B the resource market, and C households, and if flow (7) represents goods and services, then flow (6) would represent

If box A represents businesses or firms, B the resource market, and C households, and if flow (7) represents goods and services, then flow (6) would represent

A. consumption expenditures. B. goods and services. C. money income. D. resources.

The impact of financial markets on the economy comes partly through

A) the substitution effect. B) the wealth effect. C) the international trade effect. D) the travel effect.

In the Keynesian model which includes the Keynesian short-run aggregate supply curve

A) an increase in aggregate demand would causes the price level to rise, but does not change the level of real GDP. B) an increase in aggregate demand causes real GDP to rise without changing the price level. C) an increase in aggregate demand changes neither the price level nor the level of real GDP. D) an increase in aggregate demand causes real GDP and the price level to decrease.

The amount a firm receives after all costs have been paid.

a. Marginal Revenue b. Marginal Profit c. Profit d. Revenue