Assume there is no leakage from the banking system and that all commercial banks are loaned up. The required reserve ratio is 16%. If the Fed sells $5 million worth of government securities to the public, the change in the money supply will be

A. -$31.25 million.

B. -$21 million.

C. -$16 million.

D. -$11.75 million.

Answer: A

You might also like to view...

Saving is important for economic growth because

A) a higher saving rate will decrease the standard of living in the future. B) a higher saving rate increases investment spending. C) more saving increases consumption immediately. D) a higher saving rate reduces investment spending.

Supply shows

a. the quantity offered for sale at every possible price. b. the quantity people will buy at every possible price. c. the changes in quantity. d. how price changes when people buy more.

The figure below shows the marginal external benefit curve (MEB) from the domestic production of mopeds. A tariff has caused domestic production to increase from 500,000 to 600,000. The increase in external benefits to the nation of the increased production of mopeds because of the tariff is

The increase in external benefits to the nation of the increased production of mopeds because of the tariff is

A. $5 million. B. $2.5 million. C. $13.25 million. D. $7.5 million.

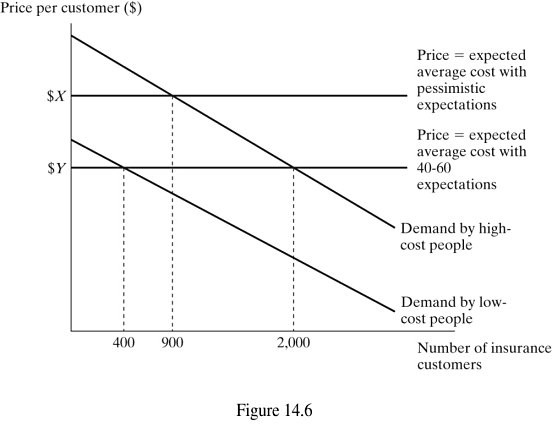

Figure 14.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. If the insurance companies are pessimistic and set their price according to their pessimistic expectations:

Figure 14.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. If the insurance companies are pessimistic and set their price according to their pessimistic expectations:

A. the companies' pessimism is not justified. B. the market will include some low-cost and some high-cost customers. C. the market will include only low-cost customers. D. the market will include only high-cost customers.