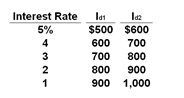

The table gives data on interest rates and investment demand (in billions of dollars) in a hypothetical economy.

Refer to the above table. Using the Id1 schedule, assume that the government needs to finance the public debt and this public borrowing increases the interest rate from 3% to 4%. How much crowding out of private investment will occur?

A. $100 billion

B. $200 billion

C. $600 billion

D. $700 billion

A. $100 billion

You might also like to view...

What are fiscal and monetary policies? Do they have an immediate effect on the AD curve or the SAS curve?

What will be an ideal response?

According to the Thomas (1954) analysis, American investment in industrial physical capital was

(a) labor-using in upswings of immigration. (b) labor-saving in upswings of immigration. (c) "labor neutral" over the course of immigration. (d) relentlessly labor-saving no matter what.

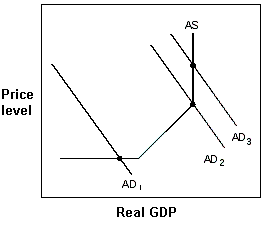

Exhibit 15-6 Aggregate demand and supply model

?

A. raise taxes to move to AD1. B. not change its policy. C. cut taxes to move to AD3. D. cut spending to move to AD3.

When a U.S. company shifts some of its production to Mexico, it is engaging in:

A. outsourcing. B. insourcing. C. self-sufficiency. D. involuntary exchange.